Silver’s unprecedented surge in 2025, with prices soaring 40-60% year-to-date, is not just another commodity blip. It’s a structural shift, driven by insatiable industrial demand, particularly from the solar and advanced technology sectors. This rally is fundamentally different from past spikes, as industrial applications now consume roughly half of the total silver supply, a significant departure from historical patterns.

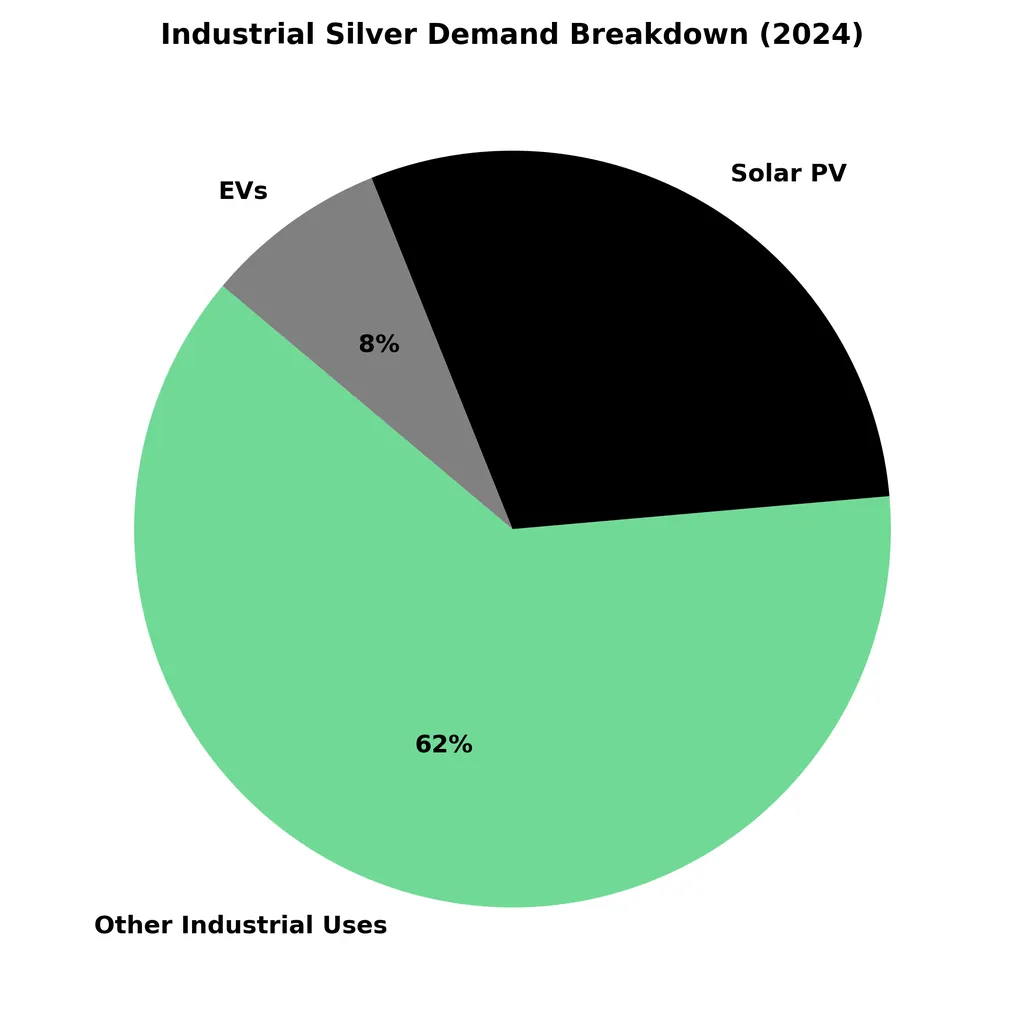

The solar photovoltaic (PV) industry is the most significant growth driver. Silver usage in solar panel production has exploded, projected to reach 232 million ounces in 2024, up from 60 million ounces in 2015. This exponential growth is a direct consequence of the global push towards renewable energy. Each solar panel contains approximately 15-20 grams of silver paste, crucial for efficient electron capture and transmission. Despite ongoing efforts to reduce silver content per panel, the sheer scale of global solar expansion ensures that overall silver demand from this sector continues its upward trajectory.

Beyond solar, the broader technology sector is also a voracious consumer of silver. The electrical and electronics industries saw silver consumption rise from 213 million ounces in 2015 to 254 million ounces in 2024. Silver’s superior conductivity is vital in semiconductor chips, printed circuit boards, CPUs, mobile phones, and a vast array of Internet of Things (IoT) devices. Demand for silver in 5G technology is projected to increase by 200% over the next decade, reaching 23 million ounces by 2030. Furthermore, the burgeoning electric vehicle (EV) market utilizes substantially more silver than traditional internal combustion engine vehicles, adding another layer to the robust industrial demand.

This robust demand is colliding with a structural supply deficit, now in its fifth consecutive year. Mine production has consistently failed to keep pace with accelerating industrial consumption, creating an imbalance that cannot be quickly remedied through new mining projects. This deficit is projected to persist and even widen through 2025-2030, putting sustained upward pressure on prices.

The dramatic ascent in silver prices creates a clear divide between potential winners and losers across various industries. Companies involved in silver mining and exploration stand to benefit significantly, seeing their revenues and profit margins expand with higher commodity prices. Conversely, manufacturers heavily reliant on silver as a key input, particularly those in the solar and electronics sectors, may face increased operational costs, potentially impacting their profitability unless they can effectively pass these costs onto consumers or innovate to reduce silver content.

Major silver mining companies such as Fresnillo PLC, Pan American Silver Corp., and Wheaton Precious Metals Corp. are poised for substantial gains. Higher silver prices directly translate into increased revenue per ounce extracted, boosting their top lines and potentially their bottom lines. Exploration companies focused on silver deposits may also see increased investment and valuation as the economic viability of their projects improves.

However, the surge presents challenges for industries where silver is a critical, often irreplaceable, component. Solar panel manufacturers, despite benefiting from the overall renewable energy boom, will face rising raw material costs. While efforts to reduce silver content per panel are ongoing, the sheer volume of production means that even marginal cost increases can accumulate. Similarly, electronics giants such as Apple Inc., Samsung Electronics Co., and other semiconductor and device manufacturers, which use silver in their printed circuit boards, connectors, and various components, will contend with higher input expenses. These companies may need to explore alternative materials, optimize designs for lower silver usage, or absorb higher costs, which could affect their profit margins or necessitate price adjustments for their end products.

The current silver surge is not an isolated event but rather a clear indicator of broader industry trends, particularly the accelerating global transition towards renewable energy and advanced technology. Silver’s role as a critical component in solar panels, electric vehicles, and 5G infrastructure firmly embeds its market dynamics within the overarching narrative of decarbonization and digitalization. This event underscores the increasing importance of “green metals” and critical raw materials in shaping future economic landscapes, highlighting how environmental policies and technological advancements are direct drivers of commodity markets.

Historically, silver has always played a dual role as both a monetary metal and an industrial commodity. However, the current surge emphasizes its industrial utility more profoundly than perhaps ever before. While past rallies were often driven by speculative bubbles or safe-haven demand amidst economic uncertainty, the current momentum has a strong underlying foundation of structural industrial demand. This contrasts with gold’s drivers, which are predominantly rooted in its status as a safe-haven asset, a hedge against inflation, and a store of value, with industrial demand playing a much smaller role.

This shift in silver’s market dynamics could reshape investment portfolios, influence production strategies, and