In the rapidly evolving landscape of strategic accounting management and consulting, a new wave of technological integration is making significant strides, promising to reshape the financial sector. A groundbreaking study published in the journal *Dyna* (translated to English as “Dynamics”) sheds light on how Artificial Intelligence (AI), Robotic Process Automation (RPA), and Big Data are revolutionizing the way accounting firms operate. Led by William Alberto Guerrero from the Fundación de Educación Superior San José in Bogotá, Colombia, this research offers a compelling glimpse into the future of financial management.

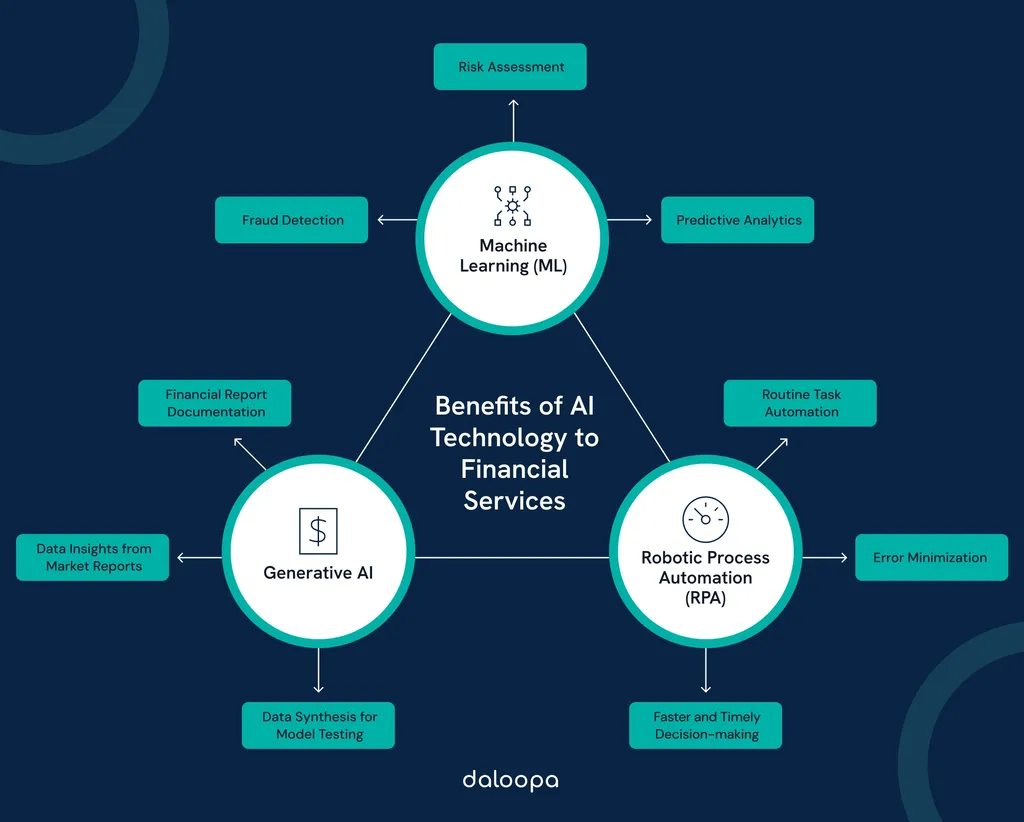

The study highlights how AI is optimizing repetitive tasks, enhancing the accuracy of financial data processing, and even facilitating fraud detection. “AI’s ability to analyze vast amounts of data in real-time allows for more precise financial forecasting and risk assessment,” Guerrero explains. This technological leap is not just about efficiency; it’s about transforming the very fabric of decision-making in the financial sector.

RPA, on the other hand, is automating audits, reconciliations, and reporting, significantly reducing errors and increasing operational efficiency. “The automation of these processes frees up valuable time for accountants to focus on strategic tasks, ultimately driving better client outcomes,” Guerrero notes. This shift towards automation is not just a trend; it’s a necessity in an increasingly data-driven world.

Big Data is playing a pivotal role in improving the analysis of financial trends and risk management. By leveraging large datasets, firms can make more informed and strategic decisions. “The integration of Big Data allows for a more holistic view of financial health, enabling firms to anticipate market changes and adapt accordingly,” Guerrero adds.

However, the journey towards this technological utopia is not without its challenges. Resistance to organizational change, digital skills gaps, the need for robust technological infrastructure, and regulatory compliance in data security are significant hurdles. Guerrero’s study employs a mixed methodology, combining a systematic literature review, case studies in accounting firms in Colombia and Brazil (PwC, Datactil), and interviews with accounting and technology experts. The findings indicate that while the adoption of AI, RPA, and Big Data improves efficiency and client confidence, their success depends on continuous training, change management strategies, and sound regulatory frameworks.

The implications for the energy sector are profound. As firms strive to optimize their financial operations, the integration of these technologies can lead to more accurate forecasting, better risk management, and ultimately, increased competitiveness. “The energy sector, with its complex financial structures and high-stakes decision-making, stands to gain significantly from these advancements,” Guerrero suggests.

This research not only redefines modern accounting but also sets the stage for future developments in the field. As firms continue to embrace these technologies, the financial sector is poised for a transformation that will enhance decision-making, increase efficiency, and drive competitiveness. The study, published in *Dyna*, serves as a beacon for the future of strategic accounting management and consulting, guiding firms towards a more data-driven and technologically advanced landscape.